Mastering Breakout Strategies in Forex Markets

Have you ever watched a currency pair trade sideways for hours, then suddenly explode in one direction? That’s a breakout, and if you’ve been using Forex breakout strategies for any length of time, you’ve probably seen your fair share of them. I still remember my first successful Forex breakout trade back in 2014 – EUR/USD had been consolidating for days when it suddenly surged through resistance. Applying proper Forex breakout strategies, I’d placed my order just above the range and… well, let’s just say I couldn’t stop smiling for the rest of the day.

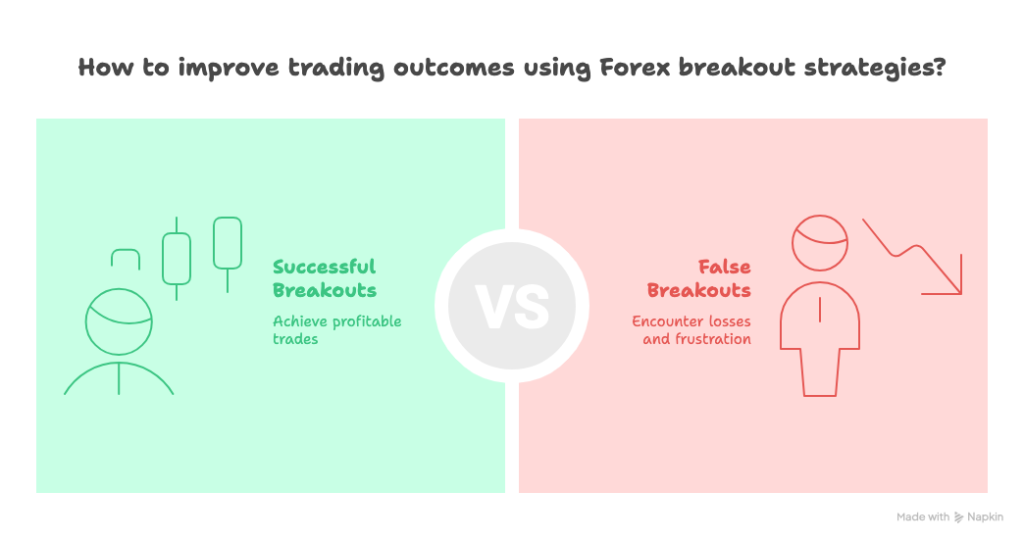

But here’s the thing – for every great Forex breakout trade I’ve caught, I’ve fallen for at least two false breakouts along the way. That’s the reality of Forex breakout strategies. They’re powerful when they work, but can be frustrating when they don’t.

So today, I’m sharing everything I’ve learned about mastering Forex breakout strategies in the market. Whether you’re just starting out with breakout trading or looking to refine your approach to Forex breakout strategies, I think you’ll find something valuable here.

What Exactly Is a Forex Breakout Strategy? Understanding the Core Concepts

A breakout occurs when price moves beyond a defined support or resistance level with increased volume, indicating a potential new trend direction. The basic idea is simple: identify a range where price has been contained, place orders beyond that range, and ride the momentum when price finally breaks through.

I like to think of breakouts as pressure building inside a container. The longer the consolidation, the more significant the move often is when price finally escapes its boundaries.

Types of Breakouts You Should Know

There are several types of breakouts you might encounter:

- Range breakouts: When price breaks out of a horizontal trading range

- Triangle breakouts: Breaking from symmetrical, ascending, or descending triangles

- Channel breakouts: Moving beyond parallel support and resistance lines

- Pattern breakouts: Breaking from classic patterns like head and shoulders or double tops/bottoms

I’ve found that triangle breakouts tend to be my most profitable setups, especially on the 4-hour charts. There’s something about the way price compresses into the apex that just seems to create more reliable momentum when it finally breaks.

Identifying High-Probability Forex Breakout Opportunities

Not all breakouts are created equal. Here’s how I separate the promising setups from the likely failures:

The Importance of Consolidation Patterns

The best breakouts usually come after well-defined consolidation periods. I look for:

- Clear, tested boundaries (at least 2-3 touches on each side)

- Decreasing volume during consolidation (showing indecision)

- Narrowing price ranges (like in triangle patterns)

- Duration of at least 10-20 candles (the longer, often the better)

When I see price compressing like a spring about to uncoil, that’s when I start getting interested. It’s like the market is giving us a hint about potential energy building up.

Volume Analysis: The Key Confirmation Tool

If there’s one thing that’s saved me from countless false breakouts, it’s volume analysis. A genuine breakout should be accompanied by a significant increase in volume.

On a practical level, I look for volume that’s at least 150% of the average from the consolidation period. No volume surge? I’m much more cautious about entering the trade.

Try this powerful Forex system that helps identify high-probability breakouts with precision

Using Technical Indicators to Confirm Breakouts

While price action is my primary focus, these indicators have proven invaluable for confirming breakout validity:

- Bollinger Bands: When price breaks beyond the bands after a squeeze (narrowing of the bands)

- Average Directional Index (ADX): Rising above 25 suggests strong directional movement

- Relative Strength Index (RSI): Looking for alignment with price direction

- Moving Average Convergence Divergence (MACD): Histogram expanding in breakout direction

I’ve found that no single indicator is foolproof, but when three or more align, my confidence in the trade increases dramatically.

My Favorite Forex Breakout Strategies That Actually Work

After years of testing different approaches, these are the strategies I’ve found most effective:

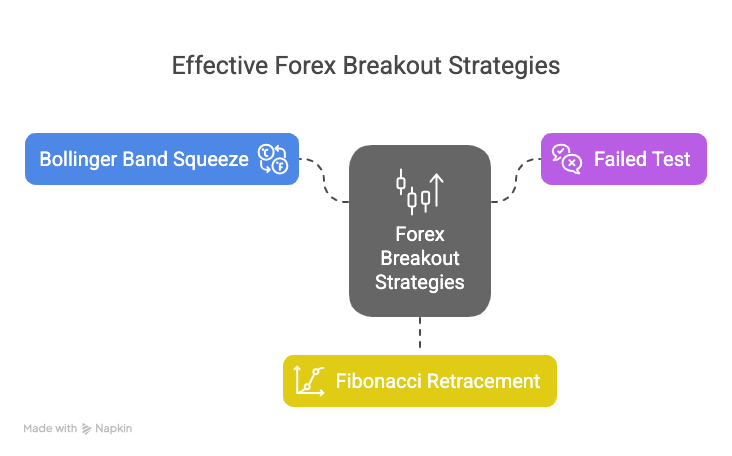

The Bollinger Band Squeeze Forex Breakout Strategy

This is probably my most reliable strategy. Here’s how it works:

- Identify when Bollinger Bands are narrowing (the squeeze)

- Wait for price to close beyond the bands with increased volume

- Enter in the direction of the breakout

- Place stop loss below the opposite band

- Target at least 2:1 reward-to-risk ratio

What I love about this strategy is how it combines volatility contraction with momentum. The narrow bands signal low volatility, which often precedes explosive moves.

The Failed Test Breakout Strategy

This is a bit counterintuitive but incredibly effective. It works like this:

- Wait for an initial breakout

- Look for price to return and “test” the breakout level

- Enter when price bounces off the level, confirming it as new support/resistance

- Place tight stop loss below the test point

I remember using this on GBP/USD last year during some Brexit news. Price broke resistance, pulled back to test, then continued upward for nearly 150 pips. The key was waiting for that confirmation on the test.

Fibonacci Retracement Breakout Strategy

This combines breakouts with Fibonacci retracement levels:

- Identify a strong prior trend

- Wait for a retracement to key Fibonacci level (usually 38.2% or 50%)

- Look for consolidation at that level

- Enter when price breaks out in the original trend direction

The power of this approach is that it combines trend continuation with breakout momentum, essentially giving you two strategies in one.

Risk Management: The Make-or-Break Factor

Let me be straight with you – without proper risk management, even the best breakout strategy will eventually blow up your account. Trust me, I learned this the hard way…

Setting Effective Stop Losses

For breakout trades, I typically place stops:

- Below the opposite side of the range (for range breakouts)

- Behind a recent swing point

- Using the ATR indicator to determine volatility-based stops (usually 1.5 × ATR)

The most important rule? Never risk more than 1-2% of your account on any single breakout trade, no matter how promising it looks.

Take-Profit Strategies That Maximize Returns

For take-profit targets, I use these approaches:

- Measuring the height of the consolidation and projecting it from the breakout point

- Using previous swing highs/lows as targets

- Trailing stops once the trade has moved 1× the risk amount in my favor

I’ve found that using a combination of partial take-profits and trailing stops works best for breakout trades. This lets me lock in some profit while still giving the trend room to develop.

Avoiding the False Forex Breakout Trap

False breakouts have been the bane of many traders’ existence – mine included. Here’s how I’ve learned to minimize them:

Recognizing Warning Signs of Failed Breakouts

Watch out for these red flags:

- Lack of volume on the breakout candle

- Immediate price rejection after breaking the level

- Breakout occurring at obvious round numbers (often hunted by larger players)

- Divergence between price and momentum indicators

One trick I’ve learned: wait for a second confirmatory close beyond the breakout level before entering. Yes, you might miss some of the initial move, but you’ll avoid many of the fakeouts.

The Patience Factor: Waiting for Confirmation

This might be the hardest part… but waiting for confirmation has saved me countless times. I typically look for:

- A strong close beyond the level (not just a wick)

- Follow-through on the next candle

- Volume confirmation

- A retest of the breakout level that holds

Patience isn’t just a virtue in breakout trading – it’s a requirement for long-term success.

Advanced Forex Breakout Strategies for Experienced Traders

Once you’ve mastered the basics, these advanced techniques can take your breakout trading to the next level:

Multi-Timeframe Analysis for Stronger Signals

I always check at least three timeframes before taking a breakout trade:

- Higher timeframe: To understand the bigger trend context

- Trading timeframe: Where I identify the breakout setup

- Lower timeframe: For precise entry timing

When a breakout aligns across multiple timeframes, it’s often much more significant. I’ve had my biggest winners when daily, 4-hour, and 1-hour charts all showed the same breakout setup.

Combining Breakouts with Harmonic Patterns

This is a more complex approach, but combining breakouts with harmonic patterns like Gartley, Bat, or Butterfly patterns can create extremely high-probability trades. The completion of a harmonic pattern often coincides with the end of a consolidation phase, setting up perfect breakout conditions.

Volatility-Based Entry and Exit Points

Instead of fixed levels, consider using volatility-based entries and exits:

- Enter after price moves a certain multiple of ATR beyond the range

- Set stops at key levels plus a volatility buffer

- Scale out of positions as volatility changes

This approach adapts to market conditions rather than imposing rigid levels.

Tools and Resources for Forex Breakout Strategy Traders

Over the years, I’ve found these tools particularly useful:

- TradingView for chart analysis and pattern recognition

- MetaTrader 4/5 with custom breakout indicators

- Currency Strength Meters to identify which currencies have momentum

- Economic Calendars to avoid trading breakouts around major news events

- Volume Profile indicators to identify key price levels

The right tools won’t make a bad strategy good, but they can make a good strategy great by helping you identify opportunities more efficiently.

Real-World Examples: My Recent Breakout Trades

Let me share a couple of recent trades to illustrate these concepts:

Last month, I spotted USD/CAD forming a symmetrical triangle on the 4-hour chart. Volume was declining throughout the formation, and Bollinger Bands were squeezing tight. After three weeks of consolidation, price broke above resistance with a strong candle and increasing volume. I entered at 1.3280, placed my stop at 1.3220, and took partial profits at 1.3340. The remaining position ran to 1.3420 before I closed it with a trailing stop.

Not all trades work out so well, though. Just two weeks ago, I thought I saw a breakout on EUR/GBP, but volume was lackluster, and the second candle failed to follow through. I exited quickly for a small loss rather than hoping it would work out. That’s a key lesson – being willing to admit when a breakout isn’t playing out as expected.

Getting Started with Forex Breakout Strategies: A Beginner’s Roadmap

If you’re new to breakout trading, here’s how I suggest you begin:

- Start by identifying and drawing clean support and resistance levels on daily charts

- Practice spotting consolidation patterns without trading them

- Begin paper trading breakouts to test your analysis

- Keep a detailed journal of your observations

- Only risk real money once you can identify breakouts with at least 60% accuracy

Remember, becoming proficient at breakout trading takes time. I’m still learning new nuances after years of trading these patterns. Don’t rush the process.

Final Thoughts: Are Forex Breakout Strategies Right for You?

Breakout trading isn’t for everyone. It requires patience during consolidation periods, quick decision-making when breakouts occur, and the discipline to cut losses when breakouts fail. If you prefer a more methodical, less reactive trading style, something like swing trading might suit you better.

But if you enjoy the thrill of catching big market moves right at their beginning… if you have the patience to wait for high-quality setups… and if you can manage the emotional rollercoaster of occasional false breakouts, then breakout trading might be perfect for you.

As for me? After all these years, I still get excited when I see a textbook consolidation pattern forming. There’s something special about successfully predicting when and where the market will make its next big move.

Now it’s your turn – what breakout patterns have you traded successfully? Or if you’re just starting out, what questions do you have about implementing these strategies? Let me know in the comments below!

Frequently Asked Questions

What is a Forex breakout strategy?

A Forex breakout strategy involves identifying when price moves beyond established support or resistance levels with increased momentum, signaling a potential new trend direction. Traders aim to enter positions as early as possible in the new move to maximize profit potential.

How do I identify a breakout in Forex trading?

Look for price closing decisively beyond a well-defined support or resistance level, accompanied by increased volume and volatility. The best breakouts typically occur after extended consolidation periods where price range narrows and volume decreases before the breakout.

What are the best indicators for breakout trading?

Bollinger Bands, ADX, RSI, and MACD are particularly useful for breakout trading. Bollinger Bands identify volatility contractions before breakouts, ADX measures trend strength, RSI confirms momentum direction, and MACD helps identify shifting momentum during consolidation and breakout phases.

How can I avoid false breakouts in Forex trading?

Wait for confirmation signals like strong closing beyond the breakout level, increased volume, and follow-through on subsequent candles. Consider waiting for a successful retest of the breakout level as new support/resistance. Using multiple timeframe analysis also helps filter out many false breakouts.

What time frames work best for breakout strategies?

Most successful breakout traders use a combination of timeframes. The daily chart works well for identifying major consolidation patterns, while the 4-hour or 1-hour charts can provide more precise entry points. For shorter-term breakout trading, the 15-minute chart can be effective during active market hours.

What is the difference between continuation and reversal breakouts?

Continuation breakouts occur in the direction of the prevailing trend after a brief consolidation period, representing a pause in the existing trend. Reversal breakouts happen against the previous trend direction, signaling a potential change in market sentiment and direction.

How do I set stop-loss and take-profit levels for breakout trades?

Place stop-losses behind recent swing points or on the opposite side of the consolidation range. For take-profits, measure the height of the consolidation pattern and project it from the breakout point, or use previous significant support/resistance levels as targets.

Are breakout strategies suitable for beginners in Forex trading?

Breakout strategies can be suitable for beginners if approached methodically. Start with clear, well-defined ranges on higher timeframes, practice with a demo account first, use proper risk management, and be prepared for false breakouts. Educational resources and mentoring can help beginners avoid common pitfalls.

What are the risks associated with Forex breakout strategies?

The primary risks include false breakouts (when price quickly reverses after breaking a level), slippage during volatile breakouts, and emotional decision-making when breakouts don’t behave as expected. Proper risk management and confirmation techniques can mitigate these risks.

Can I use automated tools for breakout trading?

Yes, there are many automated tools and expert advisors designed for breakout trading. These can help by scanning multiple currency pairs for breakout setups, sending alerts when breakouts occur, or even executing trades automatically based on predefined parameters.

Disclosure: This post contains affiliate links. If you make a purchase through these links, I may earn a small commission at no extra cost to you.